How to Buy Commercial Property

Article Summary

- Commercial property acquisitions require a structured process: define your objectives, make financial arrangements, use a broker, conduct due diligence, and complete contracts.

- Typical financing terms: 25-40% deposits, 60-75% loan-to-value, and lender DSCR requirements of 1.25-1.40+.

- Stamp Duty Land Tax (SDLT) for commercial property starts at 0% up to £150,000, then 2% to £250,000, and 5% above, with different rates than residential property.

- Essential due diligence includes financial analysis, technical surveys, and legal investigation, which typically costs 2-4% of the purchase price.

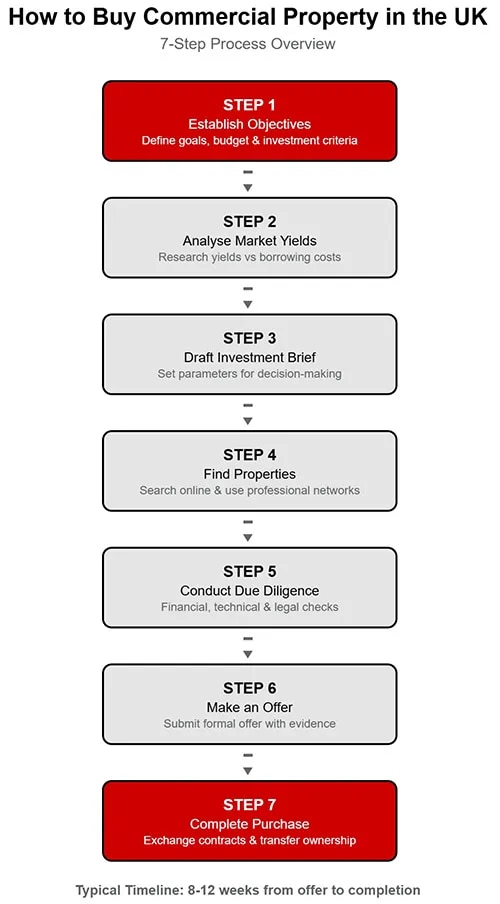

What Are the Steps to Buying Commercial Property in the UK?

Successful Acquisitions Begin with Clear Objectives, an Understanding of Market Yields, and a Disciplined Investment Brief.

Step 1: Establish Objectives

Decide whether you'll occupy the property yourself or lease it out for income. You'll also need to determine whether your priority is steady income, long-term capital growth, or a mix of both.

For example, a semi-retired investor may prefer secure rent from a long lease, while an experienced buyer might look for value-add opportunities. It's best to put numbers around your goals. Consider the income required each year to achieve positive cash flow. You'll also want to set benchmarks for your expected yield and minimum acceptable lease length.

Many investors also use cash-on-cash return at this stage to gauge whether their upfront capital is likely to generate sustainable first-year income once financing and purchase costs are factored in.

Budget Considerations

Once you've clarified your objectives, the next step is to set a realistic budget based on your available equity and borrowing capacity. This will shape both your financing options and your property search.

Most lenders require deposits of 25-40% of the property value. Loan-to-value (LTV) ratios for standard commercial assets usually fall in the 60-75% range, while more specialised properties may be closer to 50-60%. Established investors sometimes secure higher leverage, but first-time buyers should expect more conservative limits.

| Property Type | Typical Deposit | Typical LTV | Notes |

|---|---|---|---|

| Standard commercial (office, retail, industrial) | 25% to 35% | 65% to 75% | Baseline terms for stabilised income-producing assets with mainstream tenants. |

| Specialised or higher risk (hospitality, healthcare, cold storage, short leases) | 30% to 40%+ | 50% to 60% | Conservative terms due to sector risk, covenant strength, or asset complexity. |

| Mixed use (retail with residential above, etc.) | 25% to 35% | 60% to 70% | Planning and structure considerations can tighten terms compared with single-use assets. |

| Owner-occupier premises (trading business use) | 20% to 35% | 65% to 80% (case by case) | Loan terms depend heavily on business accounts, sector outlook, and affordability tests. |

Notes: Ranges are indicative and vary by lender, covenant strength, lease length, asset condition, and interest rate environment. Figures align with the article guidance: deposits 25% to 40%, standard LTV 60% to 75%, specialised assets 50% to 60%.

Step 2: Consider Working with an Agent

Most commercial property transactions involve professional advisers, and engaging a commercial agent is often the starting point. A good agent can open access to on-market and off-market opportunities, provide comparables, and negotiate terms on your behalf. For investors new to the market, this expertise can save both time and costly mistakes.

What agents typically handle:

- Sourcing and presenting suitable properties.

- Providing rental data and sales comparables.

- Advising on market yields and tenant quality.

- Negotiating heads of terms with the seller's agent.

What buyers should focus on themselves:

- Defining clear objectives and risk tolerance.

- Setting a budget and arranging finance in principle.

- Deciding on the preferred property type and location.

- Selecting a professional team (solicitor, surveyor, and accountant).

- Making the final investment decision.

Think of the agent as your guide throughout the process, but not a substitute for your own judgement. The most successful investors use professional advice while remaining disciplined about their own criteria, financing limits, and long-term goals.

Investor Tip: Choose an agent who specialises in your target sector or region. Local knowledge and sector expertise often translate into better deal flow and stronger negotiating power.

Step 3: Analyse Market Yields

Yields vary widely by region and sector, so understanding current market rates is essential. Research recent sales and rental data through property portals, agent reports, and local market intelligence. This will help you build a picture of what investors are actually achieving. The key is to always weigh yields against your borrowing costs.

If your financing costs exceed the property's yield, you'll face negative leverage from day one. This means the property generates less income than the cost of financing it. In practice, you should pay particular attention to net initial yield (NIY), which is calculated by dividing the contracted rent at purchase by the gross purchase price. This process includes all acquisition costs, such as the Stamp Duty Land Tax (SDLT).

Calculate your NIY using the net rent figure. This is the rent after deducting any incentives and landlord non-recoverable expenses. You can then compare this figure to your total borrowing costs. Always maintain a buffer between your NIY and borrowing rate to cover void periods, unexpected costs, and interest rate movements.

For a broader understanding of different yield types, read comprehensive guides on commercial property yields, which explain gross yield, net yield, and other key metrics.

Step 4: Draft an Investment Brief

A written brief acts as a one-page filter that sets parameters for location, asset type, pricing, and risk. There are several factors to consider in your brief, including:

- Intended use

- Budget and capital stack

- Yield and return targets

- Location and asset specifications

- Tenant and lease profiles

- Risk limits

- Required due diligence

- Deal structure and taxes

- Offer mechanics

A clear brief keeps your decision-making consistent. If a property does not meet the criteria, it should be set aside quickly.

When defining your asset specifications, consider the different property types available in the UK market. You might focus on office properties, retail units, or industrial and warehouse properties, each offering different risk-return profiles and tenant characteristics.

Buyers often adjust their analysis tools to match the asset type. Those focusing on offices often calculate office space before finalising size criteria so their brief reflects realistic occupancy and layout needs, while land buyers may use a land finance calculator where feasibility depends more on value and exit strategy than rental income.

Screening Tips

Before viewing a property, apply three checks to ensure that only assets that meet your financial and risk criteria will progress to the next stage:

- Is the yield above your target?

- Is debt service coverage ratio (DSCR) safe under stress testing?

- Is the lease quality in line with your risk appetite?

Think about it like this: buying starts with clarity. Define your objectives, study yields, and codify both into a concise investment brief. This foundation reduces risk and speeds up your decision-making.

Step 5: Find Properties That Match Your Brief

Once your investment brief is complete, it's time to start your property search. The most effective approach combines online platforms with professional networks to ensure you see marketed opportunities and off-market deals. Look for websites that allow you to filter by location, property type, price range, and yield, making it easy to screen opportunities against your brief. You can also set up alerts for new listings that match your criteria, ensuring you're amongst the first to see suitable properties.

Beyond online searches, maintain regular contact with local agents who specialise in your target sectors and locations. Many of the best opportunities never reach public marketing, so building relationships with agents can give you access to exclusive deals.

If you're ready to search for commercial properties, you can browse the listings on LoopNet.

Commercial Properties For Sale

Step 6: Conduct Due Diligence Checks

Due diligence is a critical part of any commercial property acquisition. It typically includes financial analysis, such as reviewing the rent roll, service charges, yields, and comparable assets.

Technical and environmental checks are just as important. Surveys assess the building's condition, EPC ratings, and potential risks, while legal investigation covers title, covenants, and planning history. Together, these steps provide a clearer view of income potential and hidden liabilities. Professional fees for this process usually amount to 2-4% of the purchase price.

To help you get started, consider reading guides like how to value a commercial building. They can provide you with detailed information on various assessment methods, from simple cost approaches to income-based valuations.

For experienced investors dealing with complex income projections or irregular lease structures, discounted cash flow (DCF) analysis can provide a more nuanced valuation that accounts for future rental growth, lease breaks, and terminal value considerations.

While this process might seem lengthy, the risks of cutting corners are high. For instance, let's say an investor bought an industrial shed without checking flood risk. Within 18 months, heavy rainfall caused major damage not covered by insurance. A simple environmental survey could have prevented the loss. You should always commission a full Royal Institution of Chartered Surveyors (RICS) building survey. Cheaper surveys may miss structural or environmental issues that can materially affect valuation and long-term returns.

Step 7: Make an Offer

When you've identified a property, the next step is to submit a formal offer through the selling agent. A strong offer does more than state a price. Back it with rental data, comparable sales, and a clear financing plan. In competitive markets, this evidence shows the seller that you are a serious buyer who can perform.

It's common to make an offer "subject to contract" and "subject to survey." These phrases protect you, allowing time for due diligence without committing until all checks are complete. If multiple bids are expected, agents may ask for "best and final" offers. In these cases, presentation matters. Highlight your financial position, lender discussions, and ability to proceed quickly.

Remember, sellers and their agents are not just looking at headline price. Certainty of completion is equally important. A buyer who demonstrates funds, has solicitor details ready, and moves promptly can often beat a higher offer with weaker terms.

Investor Tip: Before you make an offer, set your maximum price in advance. This step will prevent you from being pulled into a bidding war and keep your strategy on track.

Step 8: Complete Your Purchase

Once you complete the due diligence stage, your solicitor will exchange contracts with the seller's solicitor and you'll pay your deposit. When the deal is finalised, ownership transfers to you and the lender releases funds. You are now the legal owner responsible for management and ongoing costs.

The exchange and completion process usually takes several weeks. Your solicitor will coordinate with the seller's solicitor to finalise contracts, arrange the deposit transfer, and register the property with HM Land Registry. You will have to pay the Stamp Duty Land Tax (SDLT) within 14 days of completion, so it is essential to have funds set aside in advance.

Now that you have full responsibility of the asset, you must collect rent, cover service charges, and arrange insurance. Additionally, you must ensure that you're compliant with health, safety, and environmental standards. Many investors appoint a managing agent to handle day-to-day operations, especially when multiple tenants are involved.

Key Takeaways

Commercial property investment requires substantial deposits, specialist financing, and comprehensive due diligence, but offers attractive returns through rental income and capital appreciation. You can navigate the complex legal and financial requirements by soliciting professionals like surveyors and accountants.

Your success depends on choosing the right property type, location, and tenants while managing ongoing costs effectively. The key is to focus on long-term fundamentals. Rather than chasing short-term yield, focus on tenant quality, lease security, and sustainable rental growth.