What Is a Coworking Space? Business Models, Revenue Streams, and Investment Insights

What is a Coworking Space?

A coworking space is a shared office environment used by people from different organisations, freelancers, or remote teams. It offers desks, Wi-Fi, meeting rooms, and other office essentials, without the long term lease.

For many investors and occupiers, this question sits within a broader comparison of coworking space vs traditional offices, particularly when assessing flexibility, income structure, and long-term commitment.

Coworking Spaces Combine Flexibility with Functionality

Unlike traditional offices, coworking spaces are built for short term use and varied users. You can rent a desk for a day or book a private office for a month. It's office space on your terms. In city-centre markets, an IWG coworking space in Manchester shows how short-term desks and small, private offices support creative and digital teams without requiring long leases.

Facilities often include high speed internet, communal lounges, printers, and access to meeting rooms. Some even add extras like podcast studios or wellness rooms, depending on the space's target market.

As these options vary widely by provider and location, choosing a coworking space often comes down to how well the layout, amenities, and terms support day-to-day working needs.

Why They're More Than Just a Place to Work

These aren't just workstations, they're communities. Many coworking spaces are designed to encourage networking and collaboration. Events, coffee chats, and shared kitchens help bring members together.

That sense of community can be a huge draw, especially for remote workers who are tired of working alone or startups trying to connect with like minded businesses.

Coworking Spaces are Both Businesses and Assets

From an investor's point of view, coworking is a mix of real estate and service business. Flexible workspace occupies a unique position among commercial property types due to its operational intensity and revenue model. The space generates revenue not just from square footage, but from memberships, amenities, and add-ons.

This dual identity means investors need to evaluate both the location and the operational model. Is the operator experienced? Is the building in a location that attracts flexible workers? Those questions matter.

If you're not familiar with the different types of coworking spaces, it's worth understanding how they differ before diving in. And if you're more familiar with leasing conventional office space, take a look at this step by step guide to renting office space to see how the processes compare.

To get a feel for what's currently on the market, explore available coworking spaces for rent near you.

Coworking Space For Rent

What are the Pros and Cons of Coworking Models?

Coworking spaces offer flexibility and income potential, but they also come with operational trade offs. Understanding both sides is key before deciding to invest or convert a space.

Pros and Cons of Coworking Spaces

| Pros | Cons |

|---|---|

| Lower vacancy risk through multiple tenants instead of one leaseholder | Open plan layouts can lead to distractions and noise complaints |

| Revenue per square foot often exceeds traditional leases | Limited privacy for users handling sensitive information |

| Captures flexible demand from remote workers and startups | Limited personalisation or branding options for corporate users |

| Community-driven growth and strong word-of-mouth referrals | High member turnover if loyalty strategies are not in place |

| Low overhead with short-term memberships and shared amenities | Data security concerns in shared environments |

How to Reduce Risk in a Coworking Model

To address privacy concerns, many operators now offer enclosed private offices or soundproof pods within shared layouts. Security risks can be managed with tiered access, enterprise grade Wi-Fi, and digital key systems.

Brand dilution is another issue. Some coworking brands offer white label options so tenants can personalise meeting rooms or display company signage, subtle changes that help retain larger teams.

Churn risk can be reduced through membership tiers, loyalty discounts, and curated community experiences. Events, workshops, and member perks help build a sense of belonging, which keeps occupancy stable.

Deciding if Your Space is Right for Coworking

Start with location. Is your building easily accessible, walkable, and near amenities? Next, assess the layout. Open floor plans, natural light, and high ceilings are ideal for conversion.

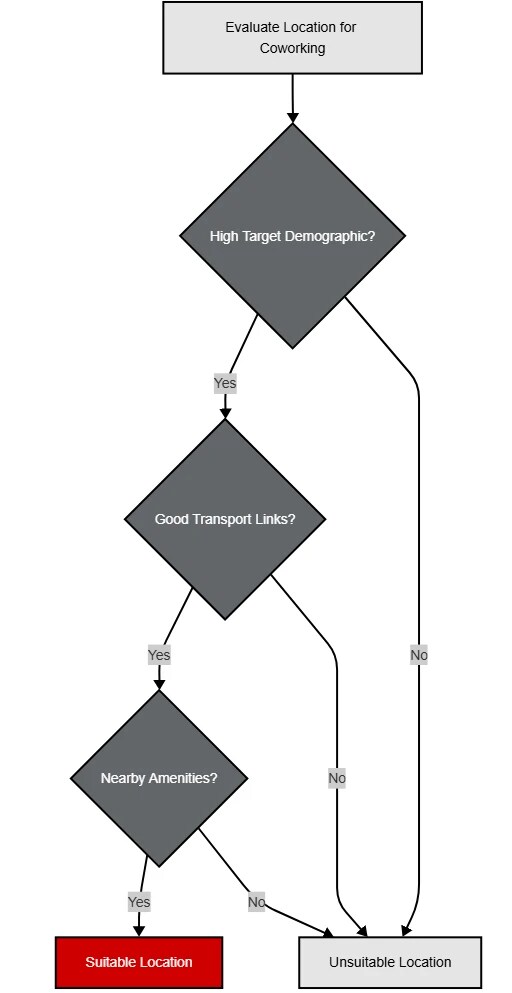

Evaluating Ideal Coworking Locations: A Decision Framework

Finally, research competition. Are other coworking spaces in the area at capacity or struggling? Use that to shape your positioning strategy. Not every market is saturate, some niches remain underserved.

If you're considering legal structures, pricing flexibility, and operating terms, it's worth reviewing common coworking agreements to better understand the commitment levels tenants expect.

How is a Coworking Space Different from an Office Space?

Coworking spaces are shared environments rented by multiple users, while traditional office spaces are private and leased to one business. The table below breaks down the major differences.

| Category | Coworking Space | Traditional Office Space |

|---|---|---|

| Occupancy | Multiple users share the space | Single tenant or company controls the full space |

| Lease Terms | Short term, pay-as-you-go | Typically long term (3-10 years) |

| Customisation | Limited branding or layout changes | Full control over layout and design |

| Costs | Bundled monthly fee (includes internet, utilities, cleaning) | Rent plus separate charges for services and fit-out |

| Flexibility | High - scale up or down easily | Low - fixed space and term |

| Best for | Startups, remote teams, freelancers | Mature businesses needing brand presence and control |

If you're leaning toward a more traditional setup, browse available office spaces for rent in your area.

Office Space For Rent

If you're comparing space types, or planning a site visit, here are some useful questions when touring office space that can help clarify what best fits your needs.

What Makes a Property Suitable for Coworking?

The success of a coworking space depends heavily on where it's located and how well the building fits the model. Not every site works, and not every neighbourhood has the right demand.

Know Your Target Demographic

Start by identifying who you're trying to attract. Are you targeting freelancers, startups, creative professionals, or corporate teams? Each group values different things. Freelancers might want a central location near cafés, while corporates look for reliable infrastructure and privacy options.

Use demographic profiling to focus on areas with a high concentration of knowledge workers, small business founders, and remote employees.

That same corporate focus appears in regional markets as well, where an IWG coworking space in Edinburgh suits firms that want a professional address without committing to long lease terms.

These are the users most likely to seek out flexible workspace. Look at local census data, LinkedIn job clusters, and coworking demand indicators, such as nearby universities, tech hubs, or startup incubators, to identify high potential zones.

Assess Transport and Connectivity

Coworking only works if people can get there easily. Prioritise walkable areas with strong public transport links, cycling access, and parking options. Multi-modal connectivity drives occupancy and justifies premium pricing.

Look for buildings near transit hubs, especially those within 5 to 10 minutes of a major station. Being close to restaurants, gyms, and banks also adds value without requiring you to build those amenities yourself.

For teams that prioritise rail access, an IWG coworking space near Victoria Station reflects how transport-led demand shapes flexible workspace pricing.

Map the Local Ecosystem

The surrounding environment shapes how your coworking space is perceived. A site in a lively business district will attract professionals who want convenience and credibility. A more artistic neighbourhood might appeal to designers or content creators looking for inspiration and energy.

Analyse the local mix of coffee shops, meeting spots, gyms, and creative businesses. These adjacent uses make your coworking space more attractive, even if you're not directly offering those features in house.

Outside the capital, a coworking space in Birmingham city centre illustrates how regional commercial cores can also sustain high-quality flexible workspace demand.

Study the Competitive Landscape

Before committing, study who else is in the area. Are there already coworking spaces? If so, are they full, or are they struggling to fill desks? You might identify a gap in price point, amenities, or specialisation.

For example, some landlords are repositioning industrial buildings under the B2 use class into coworking hubs aimed at makers or creative industries. These work well when zoning, layout, and location align.

Who Uses Coworking Spaces and Why Does It Matter?

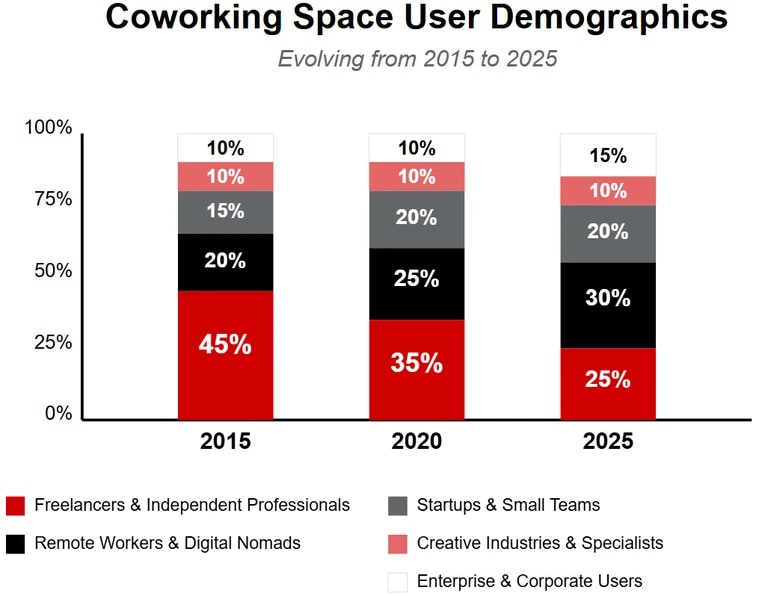

Coworking spaces aren't just for freelancers anymore. Today, they attract a wide range of users, from solo consultants to corporate teams. Knowing your audience helps you shape the offering, pricing, and amenities.

Why Audience Profiles Matter for Owners

Each user group has different expectations. Your pricing model, layout, and amenities should reflect the mix of members you want to attract. Trying to appeal to everyone usually results in a generic offer that attracts no one.

For example, a space near a retail corridor might lean into designer studios and creative tenants, especially if surrounded by high street shopping. In contrast, suburban coworking might attract corporate commuters looking for professional but convenient alternatives to the city centre.

Common Coworking User Profiles

| User Type | What They Value | Recommended Offering |

|---|---|---|

| Freelancers and Independent Professionals | Affordability, flexibility, basic amenities, separation from home | Hot desks, Wi-Fi, quiet work zones, day passes |

| Remote Workers and Digital Nomads | Structure, reliable internet, social interaction, short term access | Quiet areas, breakout lounges, short-term plans, tech support |

| Startups and Small Teams | Flexibility, scalability, credibility, all-inclusive pricing | Private offices, team rooms, meeting space credits |

| Enterprise and Corporate Users | Security, privacy, branding, regional access | Dedicated floors, branded areas, white-label options |

| Creative Industries and Specialists | Design, atmosphere, inspiring surroundings, peer network | Stylish interiors, open layouts, shared studios, community events |

Of course, many coworking spaces serve more than one audience. Your branding, location, and layout will naturally influence which mix makes the most sense for your property.

How Has Coworking Evolved Over Time?

Coworking started as a niche solution for freelancers and tech workers. Today, it's a mainstream asset class reshaping commercial office strategies worldwide. The growth has been both organic and event driven.

From Hackerspaces to Global Networks

The first wave of coworking spaces emerged in the 1990s, with Berlin's C-Base and other early adopters experimenting with shared environments. In 2005, Brad Neuberg opened the first official coworking space in San Francisco, setting the model for flexibility, community, and shared infrastructure.

By 2010, major players like WeWork scaled the concept globally. Their model introduced premium amenities, enterprise level offerings, and the idea of coworking as a lifestyle brand, not just a space.

Economic Events That Accelerated Growth

The 2008 financial crisis triggered a rise in freelance work, pushing demand for low commitment office alternatives. Then came the COVID-19 pandemic, which made remote and hybrid work the norm. Coworking spaces became a key bridge between working from home and returning to the office.

Today, coworking is not just surviving economic disruption, it's thriving because of it. The flexibility it offers aligns with how businesses now think about space.

Rapid Market Expansion by the Numbers

- The number of coworking spaces grew from 160 in 2009 to nearly 20,000 by 2020

- That figure was projected to double to over 40,000 globally by 2024—realised data is still emerging

- Before the pandemic, coworking was the fastest-growing segment in the office sector

- By 2030, flexible space is expected to make up 30% of all commercial office inventory

- Corporate teams now make up a growing share of coworking users, especially in larger cities

Coworking Adapts to Regional and Urban Trends

While city centres still lead in density, suburban coworking spaces are gaining ground. They cater to professionals who want to avoid long commutes but still need a professional setting.

Mixed use developments, retail conversions, and underutilised industrial units are also being repositioned as coworking hubs. This adaptability makes coworking appealing across a range of property types.

How Do Coworking Leasing Models Work?

Coworking spaces use flexible agreements instead of traditional leases. These models are designed to match how people work today, short term, scalable, and service based.

Common Membership Options

Most coworking providers offer multiple tiers based on user needs. These include:

- Hot Desks: First-come, first-served access to shared seating

- Dedicated Desks: Assigned desks in shared spaces with storage

- Private Offices: Enclosed rooms for teams or individuals

- Meeting Room Access: Hourly or bundled credits for bookings

- Enterprise Suites: Customisable floors or sections for large teams

Memberships can be daily, weekly, monthly, or on rolling contracts. Pricing depends on location, amenities, and access levels. Many spaces also offer global passes, drop-in day rates, or hybrid bundles for remote teams.

Operational Models Beyond Memberships

Some landlords now use hybrid structures that blend traditional leasing with coworking flexibility. These include revenue sharing deals, management agreements, or licensing models where an operator runs the coworking element within a larger asset.

These options allow property owners to stay involved in operations while reducing risk. They also open up new ways to monetise underused space without long term commitments to a single tenant.

Financial Forecasting for Coworking Spaces

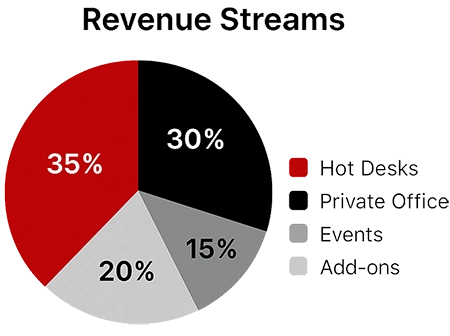

Cash flow in coworking isn't driven by rent alone. Revenue comes from memberships, add-on services (like printing or lockers), and events or virtual office plans. Forecasting needs to account for monthly churn, capacity utilisation, and seasonality.

Operators should also factor in pricing strategies, off peak discounts, loyalty pricing, and premium upgrades. When done well, coworking can deliver higher commercial property yield than fixed leases, especially in active urban markets.

Lease flexibility also plays a role in pricing review cycles. If you're navigating tenant renewal terms or inflation clauses, it's worth understanding how coworking agreements differ from a standard rent review or full repairing and insuring lease.

What's the ROI Potential of Coworking Spaces?

Coworking spaces combine property income with service based revenue, creating a different financial profile than traditional offices. For investors, the key is understanding both real estate fundamentals and operational performance.

How Coworking Generates Revenue

Unlike fixed leases, coworking income is diversified. Revenue comes from hot desks, private offices, meeting rooms, and premium services. Add-ons like mail handling, event space, or virtual offices provide additional income streams.

When run efficiently, coworking spaces often achieve higher revenue per square metre than standard offices. This is due to layered pricing and continuous churn of short term users willing to pay a premium for flexibility.

Valuation Considerations

Traditional valuation methods, such as rental yield or price per square foot, still apply, but they don't tell the whole story. You also need to evaluate:

- Occupancy across membership tiers

- Member acquisition costs and retention rates

- Revenue per square metre vs operating costs

- Brand value and pricing power

Spaces with strong retention, community engagement, and differentiated positioning can outperform their local office market benchmarks, sometimes by 2x or more.

Comparing Coworking to Traditional Office Investments

Coworking often requires more hands on management and upfront fit out costs. But it also enables faster repositioning, flexible pricing, and faster exit options if demand shifts. Traditional offices offer stability, but coworking offers adaptability and upside potential.

If you're evaluating two investment paths, weigh projected returns using both fixed lease and operational models. Factor in your risk appetite, time horizon, and whether you'll manage directly or partner with a provider.

To model performance accurately, use tools like internal rate of return for forecasting hold period returns, or estimate commercial property yield on a per member basis. You can also reference commercial building valuation methods to assess resale potential.

How Do Coworking Spaces Hold Up in Uncertain Markets?

Coworking spaces are built for adaptability. When the market shifts, they adjust faster than traditional leases, making them more resilient in uncertain conditions.

Why Flexibility Supports Stability

Income is spread across many short term users, so losing one member doesn't derail the business. Spaces can scale occupancy up or down without needing to re-lease an entire floor.

Revenue Beyond Desk Rental

Successful operators diversify income through event hire, mail handling, virtual offices, and member perks. These add-ons help buffer revenue when desk demand fluctuates.

Built-In Adaptability

Coworking spaces often use modular layouts and movable walls. This lets owners repurpose rooms or resize offerings quickly, responding to changes without major refurbishments.

Long term resilience also depends on ownership structure. If flexibility and control are priorities, weigh the pros and cons of owning the space as a freehold vs leasehold property.

Frequently Asked Questions

How do I evaluate the investment potential of a coworking space compared to traditional office assets?

Look beyond cap rates and focus on revenue per square metre, which can be 2, 3x higher for well run coworking spaces. Analyse member churn, average tenure, and customer acquisition costs to assess stability. A strong brand with loyal users often commands 15-25% higher rates than generic operators. Request occupancy data by membership tier and compare pricing against local competitors to evaluate pricing power. Finally, combine internal rate of return with actual usage patterns to forecast long-term value.

What emerging trends in corporate adoption of coworking spaces should inform my investment strategy?

Enterprise demand is rising. Companies like Microsoft and IBM use coworking for satellite offices and hybrid work models. This shift creates demand for spaces with privacy, branding options, and enterprise-grade infrastructure. High-growth locations are within walking distance of transit hubs and near corporate clusters. The most investable spaces now combine flexible layouts with long-term corporate memberships, creating yield stability with upside potential.