Flying Freehold: What It Means for UK Commercial Property Investors

What is a Flying Freehold?

A flying freehold is when part of a freehold property extends over or beneath land owned by someone else.

In simple terms, it means you own a part of a building that projects over or intrudes beneath a neighbouring property. The most common example is a room or balcony that overhangs a shared alley or access way.

Unlike a standard freehold, where you own both the building and the land it stands on, a flying freehold breaks this structure. It's also different from a leasehold or shared freehold, where ownership is either time limited or split between parties.

For investors, flying freeholds tend to appear in older or mixed-use buildings where boundaries aren't always straightforward. While they don't automatically create problems, they do introduce unique legal and practical challenges.

If you're unfamiliar with how this fits into broader ownership structures, it's helpful to explore the main types of property ownership and how flying freehold contrasts with more conventional models.

Examples of Flying Freehold

Flying freeholds aren't limited to quirky old houses, they also appear in commercial and mixed-use buildings, especially where layouts span multiple titles.

Commercial Properties with Flying Elements

In commercial settings, flying freeholds tend to show up in mixed-use developments, converted heritage buildings, and densely packed high streets. For example, a first floor office suite might jut over a neighbouring café, or a rear service corridor could run beneath another shop's storage unit.

Buildings in older city centres often come with structural quirks. Investors considering these properties should carefully review title plans and elevation drawings to spot any flying elements early in the due diligence process.

If you're evaluating properties that may involve overlapping structures or mixed-use layouts, here are some available listings in your area that could fit that profile.

Commercial Real Estate For Sale

Common Flying Freehold Setups

While flying freeholds often go unnoticed until a legal review, there are recurring structural clues investors can look for. These quick-reference examples can help flag potential issues early in a property assessment.

Typical Flying Freehold Scenarios

| Scenario | Description | Where It Occurs |

|---|---|---|

| Room Above a Passageway | Upper-storey rooms extend over shared ground-floor access ways | Semi-detached or terraced homes |

| Overhanging Balconies | Balconies project into neighbouring airspace | Modern flats, mixed-use developments |

| Basements or Cellars | Underground space extends beneath a neighbour's footprint | Historic townhouses, converted commercial units |

| Irregular Plot Lines | Buildings stray across title boundaries due to legacy layouts | Older city centres, high streets |

Legal and Conveyancing Considerations

Flying freeholds create legal uncertainty because ownership boundaries don't always align with access or maintenance obligations. These gaps are manageable, but they need to be addressed early, especially during conveyancing.

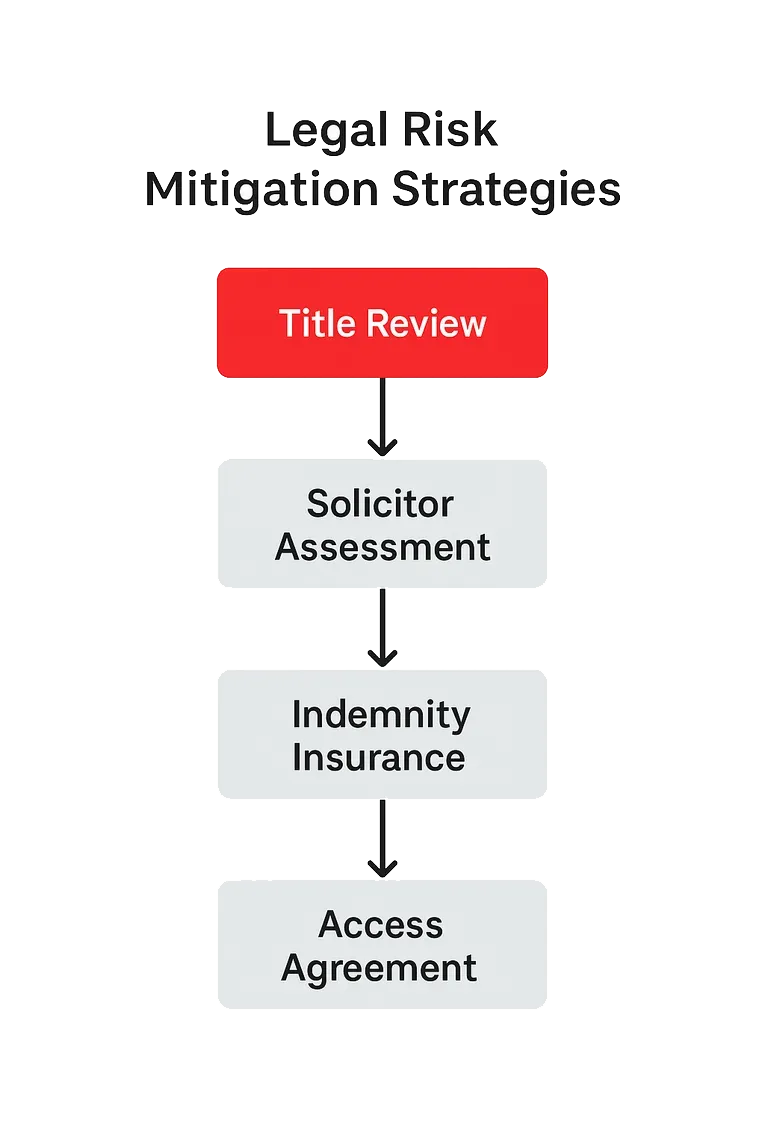

During conveyancing, solicitors often flag flying freeholds as higher risk, not because they cause daily problems, but because legal protections aren't always built in. Most concerns are manageable with planning. Investors should secure a clear legal opinion, obtain access agreements where needed, and use indemnity insurance as a backup, not a substitute, for sound documentation.

Key Legal Issues and How to Handle Them

| Legal Issue | Why It Matters | Investor Tip |

|---|---|---|

| No right to enforce maintenance | You can't force the adjoining freeholder to repair shared structures | Agree a private maintenance deed with specific terms |

| Unclear access rights | Legal access for inspections or repairs may not exist by default | Ensure access rights are granted in the title or via legal agreement |

| Covenant enforcement gaps | Positive covenants (like upkeep obligations) are hard to enforce | Solicitors may advise indemnity insurance as a fallback |

| Outdated legal framework | The Law Commission called for reform in 2011, but no changes have been implemented | Anticipate legal friction and rely on legal agreements, not assumptions |

If the flying element affects a property in an industrial or service setting, there may also be implications tied to building use classification. When reviewing commercial sites, double-check whether the premises fall within use class B2 or another special category that could impact redevelopment or maintenance plans.

In some commercial leaseholds, responsibility for structural repairs could also fall under a full repairing and insuring lease, which shifts liability to the tenant, important to clarify during legal review.

Mortgage and Lending Implications

Flying freeholds don't automatically disqualify a property from lending, but they do trigger extra scrutiny. The key issue for lenders is the legal uncertainty around access, maintenance, and enforceability.

Why Lenders Are Cautious

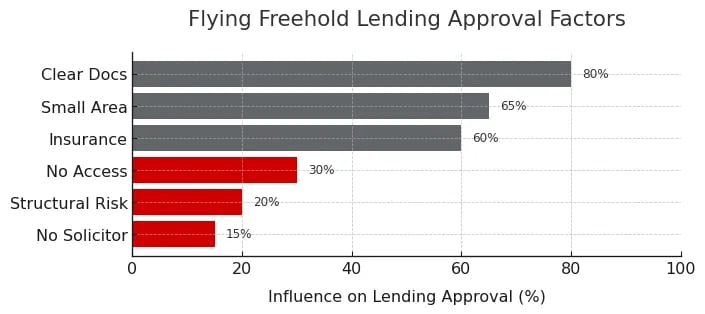

Most lenders assess flying freeholds case by case. If the "flying" element represents a small percentage of the overall property, and legal documentation is clear, they may be willing to proceed. But when access rights, covenant enforcement, or title clarity are missing, lenders may reject the application outright or impose strict conditions.

The following chart highlights how certain factors can increase or decrease a lender's willingness to approve a mortgage on a property with a flying freehold.

How Investors Can Prepare

To improve mortgage eligibility, investors should compile a detailed documentation package before applying. This includes:

- A structural survey outlining the flying freehold extent

- Legal opinion from a solicitor addressing risks and proposed remedies

- Title plans showing boundaries and ownership overlap

- Any pre-negotiated access or maintenance agreements

- Indemnity insurance quotes or active policy documentation

This level of transparency builds lender confidence and reduces the risk of delays or denials. Some lenders even have internal policies for handling flying freeholds, so it's worth checking their stance before progressing too far.

If you're buying a leasehold commercial property, the legal review becomes even more complex, since lease terms may conflict with or obscure flying freehold responsibilities.

Impact on Property Value and Investment Viability

Flying freeholds can influence value, but not always negatively. The real impact depends on how well the risks are documented and understood.

How Value Is Affected

Surveyors may apply a small discount, usually between 1% and 5%, to account for legal uncertainty. Properties without formal access rights or structural clarity tend to see more hesitation from buyers and lenders.

When It Can Be an Opportunity

Undervalued properties with minor flying freeholds can offer upside. Investors who resolve title gaps or add indemnity protection may unlock full value with minimal real risk.

Consider Yield vs Risk

If the discount exceeds the cost of risk mitigation, the deal may still work. Factor in legal fees, insurance, and lender limitations when comparing to expected rental yield.

For a full view, analyse the asset's commercial value alongside area level commercial property yields.

Future Trends and Legislative Developments

Flying freeholds are unlikely to disappear, but how the law handles them may evolve. Investors should monitor regulatory updates, especially those tied to access rights and covenant reform.

Legal Reform Remains on Hold

The Law Commission recommended changes to outdated covenant laws in 2011, but no action has followed. Until reform happens, freehold owners remain limited in enforcing maintenance or access obligations.

Lenders May Shift Policy

If lenders standardise underwriting practices for flying freeholds, borrowing could become easier. Expect slow change, as most still assess these properties individually.

Investor Takeaway

Assume legal complexity will persist and build your deal structure around it. The strongest flying freehold strategies rely on documented access rights, indemnity coverage, and forward planning—not legal reform.

Planning around unpredictable rent reviews or unusual ownership terms like peppercorn rent can further reduce future friction.