How to Invest in Commercial Property

Article Summary

- Commercial property investment can deliver stronger yields and more stable income than residential assets, but only if you avoid the mistakes that cost first-time investors thousands in lost returns.

- It suits investors who want stable, long-term income and are comfortable with higher upfront costs and a slower sales process.

- Successful commercial investing comes down to choosing the right sector, understanding the lease, running the numbers, and planning for both costs and risks.

- A clear investment strategy and a repeatable framework for evaluating properties help you compare opportunities confidently and avoid overpaying.

What Does It Mean to Invest in Commercial Property?

Investing in commercial property means putting capital into buildings used for business activity.

That includes offices, shops, industrial units, and mixed-use properties.

You can invest through direct ownership, where you select a specific building and manage the income, tenant, and lease. You can also invest indirectly through open-ended property funds, investment trusts, or listed REITs, which provide diversification with smaller minimums.

Step 1: Decide if Commercial Property is Right for Your Investment Strategy

It suits investors who want income stability, portfolio diversification, and long-term commitment.

Commercial property can offer regular rental income, potential for capital growth, and long leases that support predictability. It also behaves differently from other asset classes, which can support diversification.

At the same time, commercial property isn't for everyone. It requires more upfront capital, takes longer to sell, and can come with void periods that drain your cash reserves while you search for the right tenant. Leases and legal considerations are also more complex.

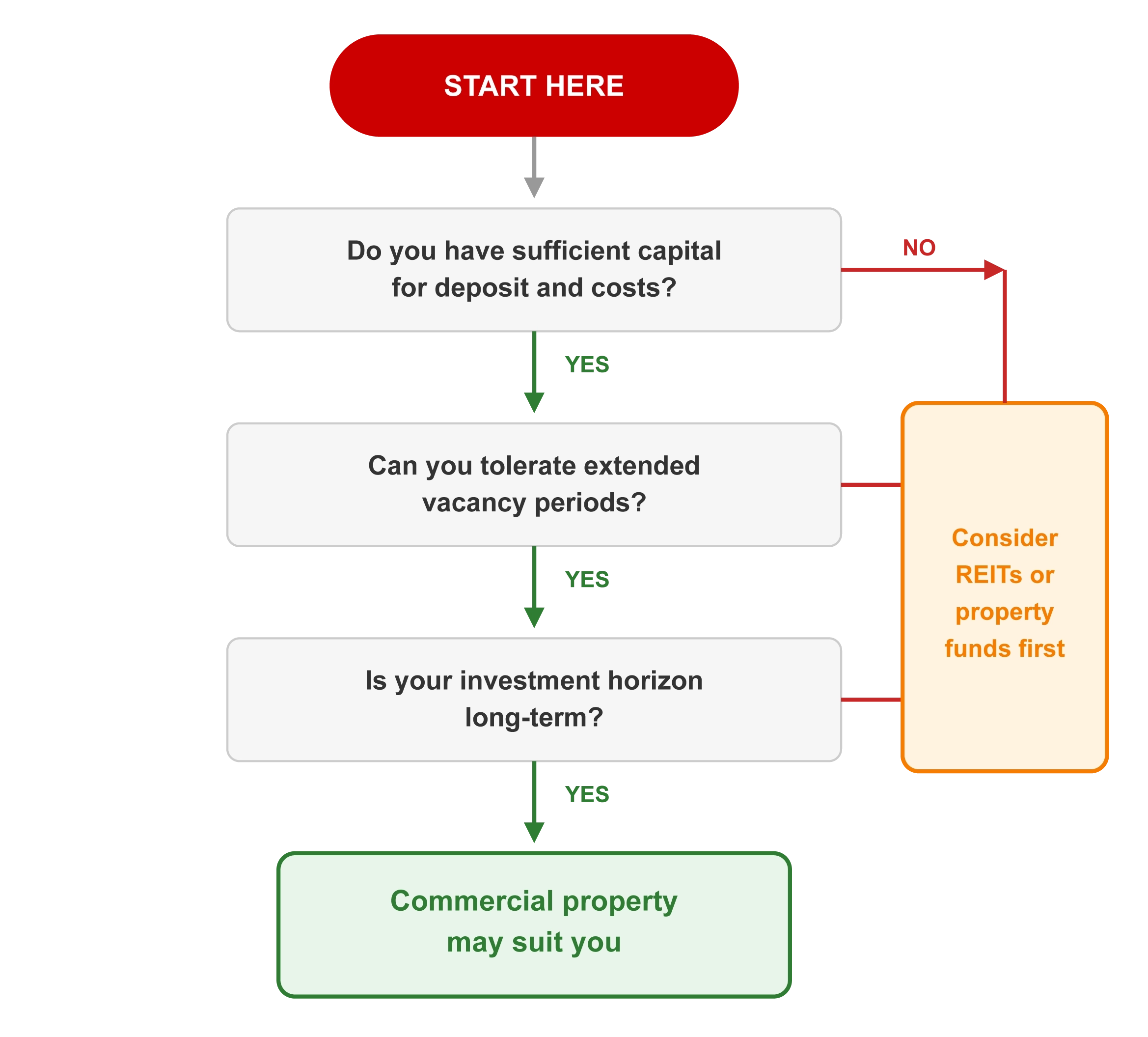

Consider your goals, tolerance for vacancies, time horizon, and whether you prefer hands-on property management or a more passive approach. Small miscalculations early on can set you back thousands, so take time to understand how each sector behaves before committing your capital.

Is Commercial Property Right for You?

Step 2: Decide What Type of Property to Invest In.

Many investors start with simpler, income-focused assets like small offices, shops, industrial units, or mixed-use buildings.

Your first commercial property sets the foundation for your entire portfolio. Choose the wrong sector, and you could face years of tenant turnover and costly vacancies.

Some of the most accessible commercial assets include:

- Retail properties, such as high street shops or small parades

- Office buildings, often used by local service businesses

- Industrial properties, including units for storage, distribution, or light manufacturing

Since each sector behaves differently in practice, the table below highlights the strengths and considerations for the main property types.

| Property Type | Strengths | Considerations |

|---|---|---|

| Industrial Units | Strong logistics demand, simple layouts, lower running costs, wide tenant base | Limited high-street visibility, may require specialised infrastructure |

| Offices | Long leases, predictable income, stable demand in strong employment centres | Sensitive to business cycles, more management and fit-out expectations |

| Retail Units | Visibility, diversified tenant mix, potential for higher yields in secondary locations | Footfall dependency, structural shifts in consumer behaviour |

| Mixed-Use Buildings | Multiple income streams, reduced vacancy risk | More complex management, regulatory considerations across uses |

Being deliberate about your first sector choice gives you a more confident starting point and reduces the risk of buying a property that does not align with your goals. Over time, many investors explore several commercial property types to build a balanced long-term strategy.

Some investors use a land finance calculator to assess land opportunities, where financing depends more on value and exit strategy than rental income.

How Do You Make Money from Commercial Property?

Your returns from commercial property come from two sources: the rent you collect after expenses, and the capital appreciation when you sell. Miss either one in your analysis, and your projected returns won't match reality.

Income return is the income you keep after paying for insurance, maintenance, management, and other running costs. It matters because it shows how much a property genuinely earns. Start with the annual rent, subtract operating costs to find net income, and compare that figure with the purchase price to estimate yield.

For example, £40,000 in rent and £10,000 in costs results in £30,000 of net income. On a £500,000 purchase, that equates to a 6 per cent yield. This gives you a clear sense of whether the income is strong enough for your goals. Some investors also use equivalent yield to account for rental growth.

Step 3: Choose a Property to Buy

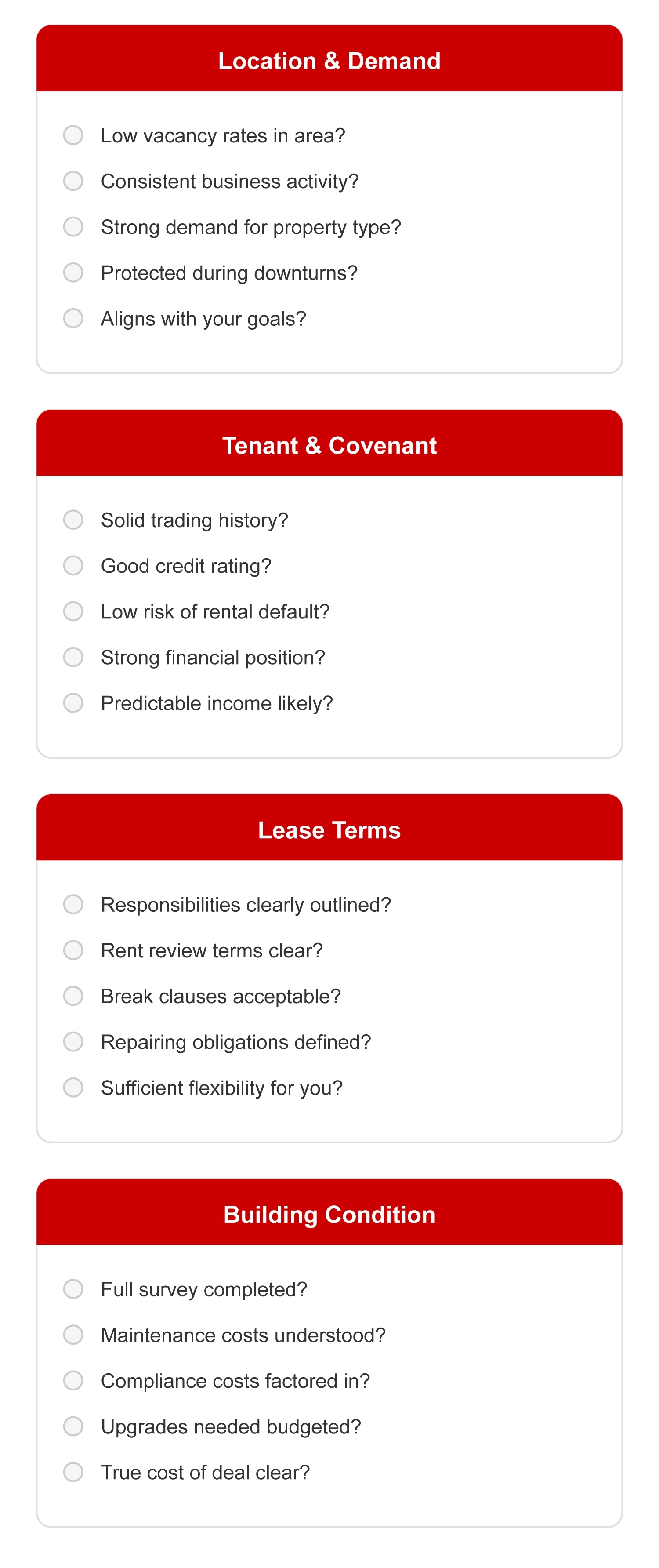

Start with a clear strategy, then focus on location, demand, tenant strength, lease terms, and building condition.

Start by setting a clear goal, whether that's stable long-term returns, maximum appreciation for an eventual exit, or something else that aligns with your unique priorities. Then, filter opportunities based on:

Location and demand

Look for areas with consistent business activity and low vacancy levels. When evaluating commercial properties for sale, prioritise locations where demand for your chosen property type remains strong, as this helps protect you during market downturns.

Tenant and covenant strength

A tenant's financial position affects your risk and the likelihood of rental defaults. A tenant with a solid trading history and good credit rating can support more predictable income, but if their position is uncertain, you may be signing on for far more risk than you initially expected.

Lease terms

A lease should clearly outline responsibilities, rent reviews, break clauses, and repair obligations. Stronger lease terms can provide more stable returns, but restrictive clauses may limit your flexibility. Taking time to understand the lease in detail helps prevent surprises later, especially if you are new to commercial investing.

Building condition

Older buildings or those requiring upgrades can look attractive, with lower prices and higher yields. But they may come with significant maintenance or compliance costs that cut into your revenue. A full survey helps you understand the building's condition and budget for repairs. Unexpected work can erode returns quickly, so factor these in early for a clearer picture of the deal's true cost.

Property Evaluation Checklist

Key questions to ask before making an offer

One way to avoid overpaying is using a commercial property value calculator to compare similar assets. For instance, a property in a declining area or with a weak tenant can turn what looks like an attractive yield into years of losses.

Review properties in your chosen market to find assets that meet your goals:

Commercial Properties For Sale

Step 4: Run the Numbers on a Potential Deal

Focus on net income, yield, and whether the rent comfortably covers your financing.

Before you look at any deal seriously, it helps to understand the core metrics a lender will evaluate. These figures show whether the income is strong enough to support a loan and whether the property is likely to meet basic lending criteria.

Net income is the rent you keep after covering operating costs such as insurance, maintenance, and management. It shows how much the property genuinely earns each year. This net income figure is often formalised through the calculation of net operating income, which investors use to compare properties consistently before factoring in financing.

Yield compares that net income with the purchase price. It helps you judge whether the income is attractive for your goals and whether the price is realistic relative to similar properties.

Debt Service Coverage Ratio (DSCR) measures how comfortably the property's income covers your annual loan payments. Lenders typically want the DSCR to sit above their minimum threshold, since it signals that the income can support the debt even during quieter periods.

If the numbers are not clear, you risk relying on assumptions instead of facts, and that can lead to costly mistakes. Getting comfortable with these figures early helps you avoid surprises and make decisions based on facts rather than optimism.

Many investors also use cash-on-cash return at this stage to see how effectively their upfront capital generates first-year income once financing and purchase costs are accounted for.

A quick review helps you rule out properties that look appealing but do not hold up once all the numbers are laid out. Estimate the rent, subtract operating costs to find net income, compare that figure with the purchase price to assess yield, and make sure the income is strong enough to cover your interest payments. Many investors also consider long-term return models such as internal rate of return (IRR) to understand how a property may perform over time.

Gross yield lets you compare different asset types.

Gross yield is a property's annual income divided by its purchase price, and is expressed as a percentage. Direct investors use it to compare opportunities across asset types:

For example, a £400,000 property earning £28,000 annual rent delivers a 7% yield. Net initial yield (NIY) is another metric investors use to understand how a property's income compares with its purchase price. Unlike gross yield, NIY factors in operating expenses to give a more accurate profitability estimate.

Step 5: Plan for Costs and Risks

Include transaction taxes, professional fees, regular operating costs, and financing risk so your projected return is realistic.

Unexpected costs kill returns, so plan for them up front to protect your cash flow. Investors who budget only for purchase price and mortgage payments often find themselves cash-strapped when maintenance, vacancies, or rate increases hit. Building a full picture early gives you more control and helps you avoid common mistakes that catch new investors off guard.

Upfront costs:

- Stamp Duty Land Tax (SDLT)

- Legal fees

- Valuation and survey costs

Ongoing costs:

- Insurance

- Maintenance and repairs

- Commercial property business rates

- Property management

- Vacancy periods

Key risks to plan for:

- Tenant failure can leave you covering mortgage payments with no income

- Prolonged vacancies drain cash reserves while you search for quality tenants

- Rising interest rates can turn a profitable deal into a break-even or loss

- Unexpected repairs, from roof replacements to structural issues, can run tens of thousands of pounds

Planning ahead will not eliminate these risks, but it makes them manageable and helps prevent long-term financial problems.

Frequently Asked Questions

How much money do I need to invest in commercial property?

The exact amount will depend on your chosen asset, and commercial lenders typically require deposits of 20-40%. You should also budget for SDLT, legal fees, surveys, and ongoing running costs. Creating a full budget up front prevents the financial surprises that often derail first-time investors.

What yield should I aim for?

Yields vary by property type and risk. Prime office yields in major cities typically range from 4-6%, retail yields from 5-8%, and industrial from 4-7% for prime assets. Secondary properties with higher risk yield more. Balance yield against tenant quality and lease security. The key is to ensure the yield reflects both the risks and the long-term income potential of the property you are evaluating.

What are the biggest risks with commercial property?

The biggest risks are tenant default (which can leave you covering expenses with no income), extended vacancies that drain your cash reserves, rising interest rates that squeeze margins, and unexpected repairs that can cost tens of thousands. Planning for these scenarios is essential, not optional. Knowing these risks upfront helps you build a more resilient strategy and reduces the stress that comes with unexpected costs.