How to Sell Commercial Property

Article Summary

- Strong preparation and transparency help attract confident buyers, reduce renegotiation risk and shorten time on the market.

- Complete documentation and a compliant Energy Performance Certificate (EPC) show that the property is well managed, which supports smoother due diligence.

- Your chosen sale route influences speed, buyer competition, and price certainty, so match the method to your objectives.

- Business owners benefit from a structured, low-surprise process, while investors focus on yield, timing and lease-driven value.

Selling commercial property isn't just about putting a “For Sale” sign on the building and waiting for offers. The value you earn, and the time it takes to complete the sale, largely depends on what you do before the marketing begins.

Whether you're a business owner selling your premises or an investor looking to achieve your target sale price, a clear, prepared, and data-driven approach will maximise your outcome.

Selling commercial property represents a significant financial decision, and mistakes can cost you tens of thousands in lost value or months of delays. Each stage in the process, from pricing and preparation to marketing and completion, affects how smoothly your sale proceeds and how much value you ultimately achieve.

Selling a property is one stage in the broader cycle of investing in commercial property, and many owners link the two when planning their strategy.

Step 1: Decide When to Sell

The best timing depends on lease events, market liquidity and capital expenditure cycles.

Look for moments when your property's fundamentals are strong, such as a long lease, recent rent review, or minimal upcoming capital costs. Selling before major works or expiries can help you capture maximum value. Poor timing can leave substantial money on the table, while strong timing can help you achieve a meaningfully higher sale price.

Investors often use discounted cash flow (DCF) models to project future income and identify an optimal time to sell. Analysing internal rate of return (IRR) can also help owners decide whether to sell now or hold for future income growth.

Step 2: Price Your Property

Focus on comparables, income potential, and buyer appetite.

Selling a commercial property starts with setting a defendable guide price that reflects market comparables, income potential, and what qualified buyers are willing to pay for similar assets.

Pricing a commercial building should reflect how a buyer underwrites the asset. Buyers typically rely on three valuation approaches: income (yield based), comparable sales, and cost to replace.

This underwriting logic differs for land-led assets, where buyers often focus on funding structure and exit strategy, and may use tools such as a land finance calculator to sense-check feasibility rather than rental income.

The income approach carries the most weight for investment property. Factors such as weighted average unexpired lease term (WAULT), tenant covenant strength, vacancy level, and location all drive the yield.

Understanding how buyers assess opportunities when purchasing commercial property can help you set a more realistic and defendable guide price. Consider other factors that might allow you to list your property at a higher price, as well. For example, owner occupiers often pay a premium compared with investors because they value occupation in addition to yield.

Obtain a valuation for a commercial property and check local commercial properties for sale to help you set a defendable guide price. Be sure to review listings for properties similar to your own, whether that's office properties for sale, industrial properties for sale, or another property type, to benchmark enquiry levels and yield expectations.

Step 3: Prepare Your Documentation

A complete, transparent information pack attracts serious buyers and stronger offers.

Buyers want certainty. By having due diligence items ready, you reduce negotiation risk and speed up the process. Think of it like this: A poorly prepared information pack signals risk to buyers, triggering lower offers and longer negotiations.

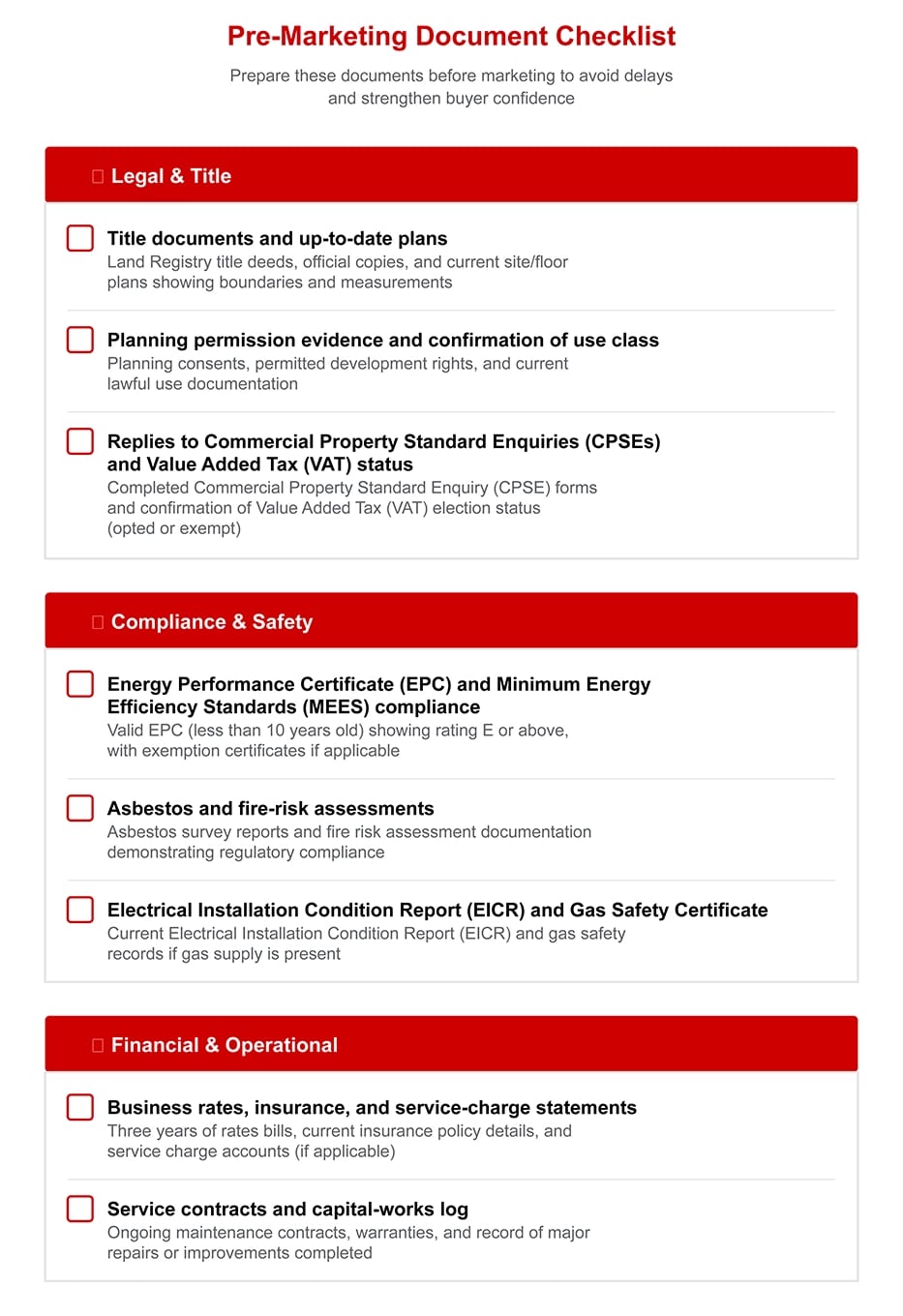

Here's your checklist:

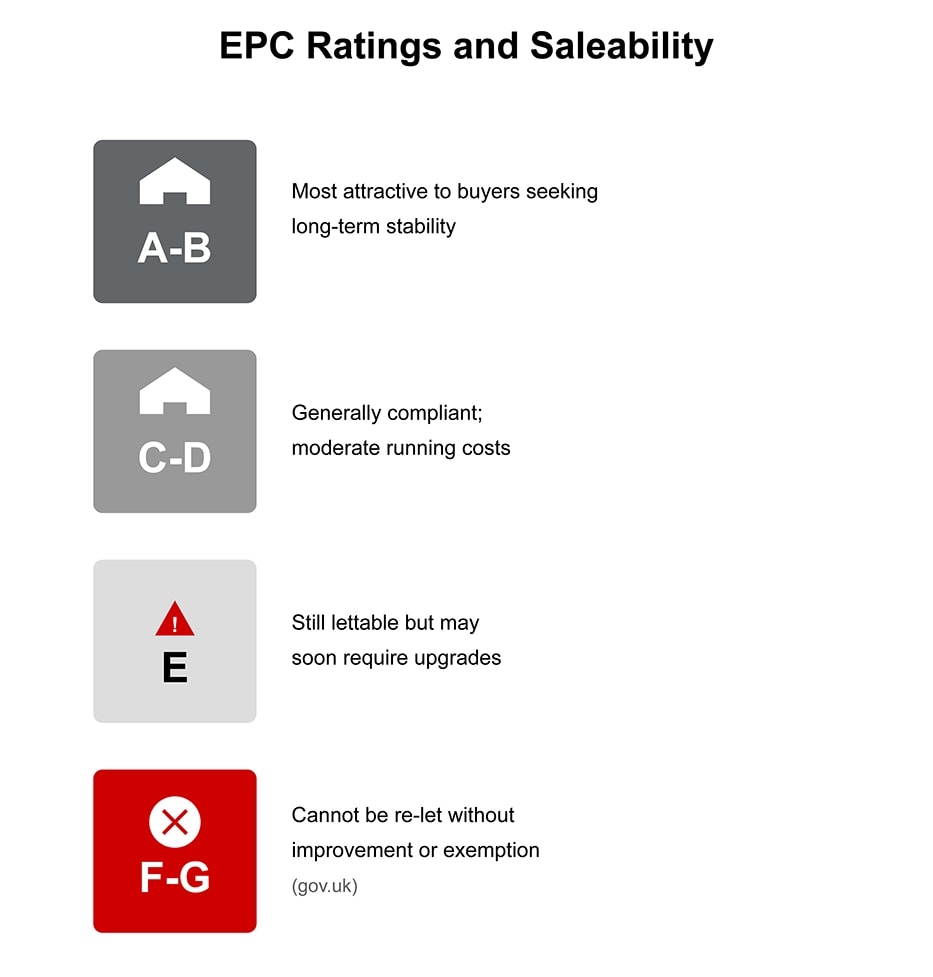

Poor EPC ratings can limit saleability and reduce pricing power, while compliant properties attract stronger buyer demand.

Since 1 April 2018, commercially let properties with an EPC below rating E cannot be legally let or re-let unless improved or granted a valid exemption under MEES regulations. If your property falls below rating E, address this before marketing to avoid buyer objections and price reductions.

Improving an EPC rating can expand your buyer pool and strengthen pricing power.

For example, a retail unit with a high EPC rating and low operating costs may attract stronger offers from buyers seeking stable, long-term returns.

Yield performance is another factor investors monitor closely, and understanding how it changes can influence decisions about energy upgrades or timing a sale. Commercial property yield plays a key role in how buyers evaluate pricing and risk.

Even if you are selling an owner-occupied asset, remember that a potential future buyer may want to lease it. Be clear on the building's performance, any upgrades already completed, and realistic improvement costs if needed.

Step 4: Choose a Sale Route

Choose the route that aligns with your asset type, timescale and price expectations.

Each selling route offers a different balance of control, speed, and certainty. Understanding how they work helps you match your strategy to the type of asset and buyer you're targeting.

Choosing the Right Sale Route

This table compares common sale routes for commercial property, highlighting the ideal use case, key strengths, and considerations for each approach.

| Sale Route | Best For | Strengths | Considerations |

|---|---|---|---|

| Auction | Smaller or unique assets | Fast and transparent, creates competition among bidders | Lower price certainty, tight deadlines |

| Private Treaty | Income-producing or investment assets | Flexible negotiation, allows time for due diligence | Longer process, risk of buyer withdrawal |

| Off-Market | Confidential or tenant-sensitive sales | Discreet process, limited disruption | Smaller buyer pool, less price tension |

Each option has trade-offs. Auctions may deliver a faster sale but often result in lower sale prices. Private treaty allows full negotiation and due diligence but can lead to buyer fatigue. Off-market preserves confidentiality but may reduce buyer competition. Match the route to your circumstances, since different types of commercial property appeal to different buyer profiles based on lease length, tenant demand and location.

Step 5: Find and Attract Qualified Buyers

Pair targeted agent outreach with high-visibility marketing.

Start by compiling a buyer list through active agents and databases. Your marketing should reflect professional standards with clear photos, detailed floor plans, and accurate data sheets. A secure data room helps manage due diligence efficiently.

An experienced agent can add measurable value during the sale process. Understanding the reasons to hire a commercial property agent can help you position the asset, reach qualified buyers, and manage negotiations effectively.

Clear heads of terms protect deal momentum and set expectations for all parties.

Once you receive an offer, draft clear Heads of Terms to summarize the main points of the deal. Heads of Terms are a preliminary agreement and typically cover:

- Price

- Timing (exchange and completion)

- Deposit

- VAT treatment

- Conditions

- Inclusions

- Warranties

- Break or leaseback clauses if relevant

A well-drafted Heads of Terms reduces ambiguity, limits legal renegotiation, and keeps the deal on track.

Step 6: Manage Timelines After You Receive an Offer

Stay proactive and maintain steady communication.

Once Heads of Terms are signed, set clear responsibilities and a timeline. Assign a single point of contact for buyer queries and legal drafting. Confirm buyer funding early, maintain a secure data room for Q&A, and set realistic milestones, usually six to 12 weeks from offer to completion. Every week without progress adds to your holding costs and can erode buyer confidence.

Understand your VAT and Capital Gains Tax position early to avoid delays and unexpected.

Whether you opt to tax under VAT Notice 742A affects buyer demand, deal structure, and your net. Opting lets you reclaim VAT on your sale costs and often suits VAT-registered investors. If the deal qualifies as a transfer of going concern (TOGC), no VAT is charged on the price. Not opting keeps VAT off the price, which can help with buyers who are not VAT-registered, such as owner-occupiers or charities. The trade-off is you cannot reclaim VAT on your costs, so your net may be lower.

For freeholders, it may help to review the basics of freehold commercial property, since ownership structure can influence both tax and sale documentation.

For Capital Gains Tax (CGT), the taxable gain is calculated as the sale proceeds minus the original purchase price and allowable costs like improvement works, legal fees, and agent commissions. Capital Gains Tax on commercial property is reported through your annual Self Assessment tax return and paid by 31 January following the tax year of the sale.

Because tax rules are complex, engaging qualified advisers early is wise.

Key Takeaways

Preparation and transparency help attract stronger buyers and reduce time on the market. When your documentation is complete and your EPC is compliant, buyers feel confident in the quality of the asset and the way it has been managed. That confidence often sets the tone for smoother negotiation and fewer surprises.

Your sale route, marketing strategy and buyer targeting all influence speed and price certainty. Tax and compliance considerations such as VAT, CGT and MEES also shape your net outcome.

Whether you’re a business owner aiming for a straightforward exit or an investor looking to sell at the right moment, the decisions you make early on can shape the results you achieve.

Commercial Properties For Sale

Frequently Asked Questions

How long does it take to sell a commercial property in the UK?

Most sales take between six and twelve weeks from offer to completion, depending on how quickly solicitors exchange contracts and how ready the seller's documentation is. Properties with complex leases or funding conditions can take longer.

What costs are involved in selling a commercial property?

Typical costs include agency fees, solicitor fees, and potential Capital Gains Tax if the property has appreciated in value. You may also need to budget for energy upgrades or compliance certificates before sale.

Do I need a commercial agent to sell my property?

An experienced commercial agent can help you price realistically, reach qualified buyers, and manage negotiations efficiently. Their market data and buyer networks often lead to faster and more competitive offers.

Can I sell a commercial property with tenants in place?

Yes. Properties with tenants are often sold as income-producing investments. You'll need to provide copies of the lease, rent payment history, and details of any service charges or tenant covenants to prospective buyers.

How do I make my property more attractive to buyers?

Ensure all documents are complete and up to date, highlight strong lease terms or tenant quality, and present the space clearly in marketing materials. A compliant energy rating and well-organised data room also build buyer confidence.