Types of Property Ownership in the UK and How They Impact Your Investment Strategy

Property Ownership Structures

Choosing the right ownership structure isn't just a legal decision, it's a strategic move that can shape your entire commercial investment journey.

In the UK, commercial property ownership can be understood in two key dimensions:

Ownership Structure

Who owns the property and how that ownership is divided:

- Sole ownership

- Joint ownership (joint tenants or tenants in common)

- Shared ownership

- Commonhold

Ownership Tenure

What is actually owned and for how long:

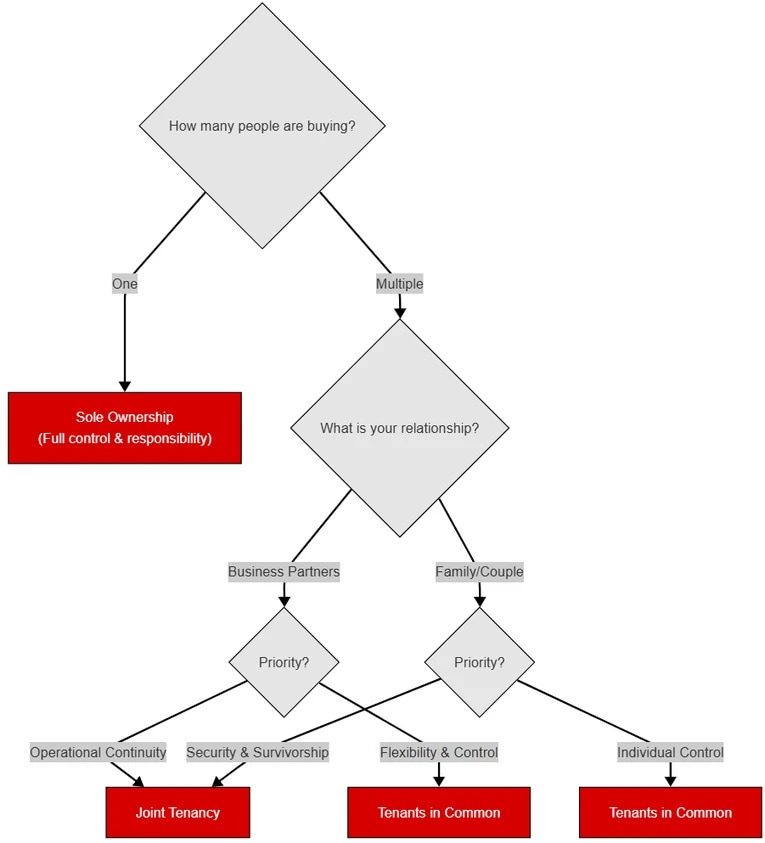

Choosing the Right Property Ownership Structure

Choosing the right property ownership structure comes down to control, risk, and your relationship with co-investors. Sole ownership offers complete autonomy but places all responsibility on one party. Joint tenancy is best when partners want equal control and automatic succession. Tenants in common gives you more flexibility in how ownership shares and inheritance are structured, ideal for families or unequal contributions.

Ownership Type Determines Risk, Control, and Long Term Value

Commercial investors should think of ownership structures as tools. The structure you choose affects who holds decision making power, who carries liability, and how value is preserved or transferred over time. For example, freehold vs leasehold ownership can significantly influence maintenance costs, resale value, and your ability to refinance or redevelop the property.

Linking Ownership Structures to Investment Strategy

Each ownership type comes with trade offs that should be matched to your goals. If you're building a long term portfolio, freehold ownership may offer stability and capital growth. If you're focused on short term gains or shared risk, joint ownership structures or leasehold arrangements might align better with your strategy.

| Investment Goal | Best-Suited Ownership Types | Why It Fits |

|---|---|---|

| Long term capital growth | Freehold, Sole ownership | Full control over asset and exit; no ground rent or lease expiry issues |

| Equal risk partnership | Joint tenancy | Simplifies management and ensures survivorship continuity |

| Unequal contributions or shared investment | Tenants in common, Company ownership | Ownership shares can reflect capital input and provide flexible exit options |

| Short term hold or step up investment | Leasehold, Shared ownership | Lower entry cost and reduced commitment for early stage investors |

| Estate planning or generational control | Tenants in common, Company ownership | Assets can be left to heirs or transferred via shares, enabling inheritance flexibility |

Ownership structure also plays a role in how easily you can exit an investment. For instance, shared freehold arrangements may require unanimous agreement to sell the building, while sole ownership gives you full autonomy. These factors should be mapped against your exit strategy from the outset.

Freehold, Leasehold, and Shared Freehold

Every commercial property deal is built on one of these foundations: freehold, leasehold, or shared freehold. Each comes with different levels of control, cost, and legal responsibility.

Freehold Ownership: Maximum Control and Long Term Value

Freehold means you own the property and the land beneath it outright. For commercial investors, this is often the preferred structure when looking to hold and manage an asset long term. You're not subject to external lease terms or ground rent obligations, which makes planning and repositioning easier over time.

This is especially attractive with office buildings for sale, where refurbishment or mixed use redevelopment is part of the investment strategy. With freehold, you can align the asset with broader portfolio goals without needing a freeholder's permission.

Office Buildings For Sale

Leasehold Ownership: Lower Entry Cost, Higher Complexity

Leasehold is common in cities where land is scarce and development is dense. In this arrangement, you own the property for a fixed period but not the land it sits on. The freeholder retains ownership of the land and common areas.

This structure is common with flats, upper floor retail, and even converted industrial buildings. As a leaseholder, you're subject to service charges, lease terms, and sometimes restrictive clauses on alterations or subletting. Leases with less than 80 years remaining may also reduce property value and create financing challenges.

Shared Freehold: More Control, But Shared Responsibility

Shared freehold is a hybrid model. Typically, leaseholders in a building form a company to collectively purchase the freehold from the current owner. They still hold leasehold title, but now they own the freehold company as well.

Also worth noting: while shared freehold helps with lease extensions, it doesn't remove the need to manage both roles, you're still a leaseholder and now a part owner of the freehold entity.

Ground rent obligations can vary significantly depending on whether the property is held under leasehold or shared freehold. In some cases, ground rent clauses can lead to long term cost escalation, while others may be structured as a peppercorn rental with no financial impact. It's important to review lease terms carefully and understand how ground rent is calculated before committing to a leasehold or hybrid structure.

To see how different ownership types are reflected in current listings near you, explore available commercial properties.

Commercial Real Estate For Sale

Sole Ownership for Commercial Investors

Sole ownership means one person or legal entity holds full title to the property. They make all decisions, carry all liabilities, and receive all profits from the investment.

Full Control, Full Responsibility

Sole ownership offers direct control. You can buy, sell, lease, or develop the property without needing consent from others. This can streamline operations and speed up decision making.

However, you're also solely responsible for risks, legal claims, vacancies, and capital losses all fall on you. Many investors manage this by holding the property through a company or trust to limit personal liability.

Strategic Advantages of Sole Ownership

There's a certain satisfaction in calling all the shots. Sole ownership gives you that, unfiltered control over strategy, management, and future resale. For seasoned investors, this can unlock efficiency others simply can't achieve when co-owners are involved.

Take, for example, a private investor purchasing a freehold industrial unit in the West Midlands. With sole ownership, they can let the space on flexible terms, refinance against capital growth, or reposition the asset entirely, without needing anyone else's sign off. For scenarios like this, where stability and autonomy matter, freehold assets make strategic sense.

Risk Management Tools for Solo Investors

Ownership through a limited company is common. It protects personal assets while keeping operational control. Another strategy is layered insurance, buildings insurance, public liability, and loss of rent cover are essentials.

Investors also use financial metrics like commercial property yields and rental yield to monitor performance and make risk informed decisions.

Joint Ownership Structures: Joint Tenancy vs. Tenants in Common

Joint ownership allows two or more parties to co-own a commercial property. While this sounds simple on paper, how you structure the arrangement, either as joint tenants or tenants in common, makes a significant difference.

Understanding the Legal Frameworks

With joint tenancy, all parties own the property equally. If one person passes away, their share automatically transfers to the surviving owners. This is called the right of survivorship. It's a common setup for business partners who want operational continuity without triggering probate or inheritance complications.

Tenants in common works differently. Each party can own a specific share of the property, whether that's a 50/50 split or something less symmetrical like 70/30. And if one party dies, their share goes to their estate, not the other owners. It's typically the go to choice for unrelated investors or family members pooling funds while maintaining individual control.

Aligning Ownership Structure with Investment Strategy

Not all commercial investments are partnerships, but when they are, the legal setup matters. Joint tenancy is often used in two person partnerships where trust is high and continuity is critical. Tenants in common offers more flexibility, particularly in larger syndicates or situations where ownership stakes are uneven.

Imagine two investors acquiring a retail unit in Birmingham. One contributes 60% of the capital, the other 40%. As tenants in common, they can reflect that split legally, and each can pass their share to different beneficiaries if they choose. That's a level of customisation joint tenancy simply doesn't provide.

For longer-term projects, tenants in common is generally the more adaptable model. But if you're building a legacy asset with someone you trust completely, joint tenancy might offer peace of mind, especially with the right internal rate of return target in place.

Legal, Financial, and Tax Implications

Each ownership type comes with different responsibilities, tax treatment, and planning implications. Use the table below to compare key factors.

| Ownership Type | Legal Duties | Tax Treatment | Inheritance Impact |

|---|---|---|---|

| Freehold | Full responsibility for structure, compliance, and insurance | Subject to income and capital gains tax (if held personally) | Asset passes via will or company structure |

| Leasehold | Bound by lease terms; pays service charges and ground rent | Same as freehold; financing may be harder for short leases | Depends on lease length and structure |

| Joint Tenancy | Shared ownership; decisions must be unanimous | Income split evenly; CGT shared on sale | Right of survivorship—bypasses will |

| Tenants in Common | Defined shares; written agreements recommended | Taxed on share of income/gain | Each share passes through owner's will |

| Company Ownership | Company holds title; director responsibilities apply | Corporation tax on profits; CGT on sale | Shares can be transferred or inherited |

Additional factors like full repairing and insuring leases and use class regulations can also affect obligations, especially in mixed-use or multi-tenant properties.

Risk Management and Strategic Exit Planning

Ownership structure plays a major role in how you manage risk and exit a commercial investment. Some models make it easier to pivot or offload assets. Others offer stability but limit flexibility.

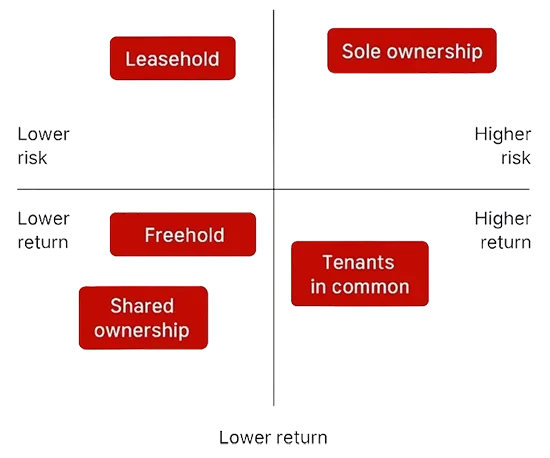

Property Ownership Risk - Reward Matrix

How Ownership Affects Risk Exposure

Sole owners carry the most direct risk, legal claims, vacancies, or income shortfalls hit them alone. Using a limited company or trust structure can help ring fence liabilities, especially in high value or operationally complex properties.

In joint arrangements, risk depends on the agreement. Tenants in common allows investors to isolate their exposure and exit independently, while joint tenancy binds everyone to collective decisions. Without a clear plan, one partner's problem can quickly become everyone's.

Choosing Ownership That Matches Your Exit Strategy

If your goal is to flip the property or exit early, flexibility matters. Leasehold investments might suit short-term plays, especially where lease extensions or management upgrades add value. But longer leasehold terms often attract buyers looking for income rather than capital gain.

For long term holds, freehold offers the broadest range of exit options—sale, refinance, or phased development. It also avoids reliance on third parties to approve asset changes. This can be especially important in assets like retail units where use class shifts or tenant repositioning can materially affect resale value.

Joint owners should think beyond day one. If one partner wants out, can they sell their share? Is there a buy-sell clause? These details matter when your investment horizon stretches five or ten years.

Use financial tools like net initial yield, equivalent yield, and reversionary yield to model your return scenarios and exit timelines. These metrics can help shape whether an ownership model supports your long term goals, or works against them.

Frequently Asked Questions

Does the ownership structure affect my ability to get a mortgage?

Yes. Lenders assess risk based on who owns the property and how. Sole owners are fully liable. In joint ownership, all parties typically need to qualify. Company structures may open doors to more financing options but often require personal guarantees. Lenders also look closely at lease terms and affordability metrics such as debt service coverage ratio (DSCR), especially on leasehold deals.

Can I change the ownership structure after purchase?

You can, but it comes with tax, legal, and potential stamp duty implications. For example, moving from sole to joint ownership or transferring a property into a company may trigger capital gains tax. Always run the numbers with a solicitor and accountant before making changes.

How do I determine which ownership structure is best for my commercial property investment?

It depends on your goals. Sole ownership gives you full control and direct exposure to risk and reward. Joint structures work well if you're partnering, but you'll need a clear agreement. Company ownership can offer tax advantages and liability protection but comes with more admin. Speak to a solicitor or tax adviser to match structure to strategy.

What are the key differences between joint tenancy and tenants in common for commercial property?

Joint tenancy means equal ownership and automatic transfer of shares when one party dies. Tenants in common allows unequal shares and the ability to leave your portion to someone else. For investment partnerships, tenants in common is usually more flexible, especially when capital contributions differ.