How many Industrial Property listings are available for sale in Homerton?

There are currently 0 Industrial Properties available for sale near Homerton.

These Homerton Industrial Property listings have an average size of.

The largest available listing in Homerton is.

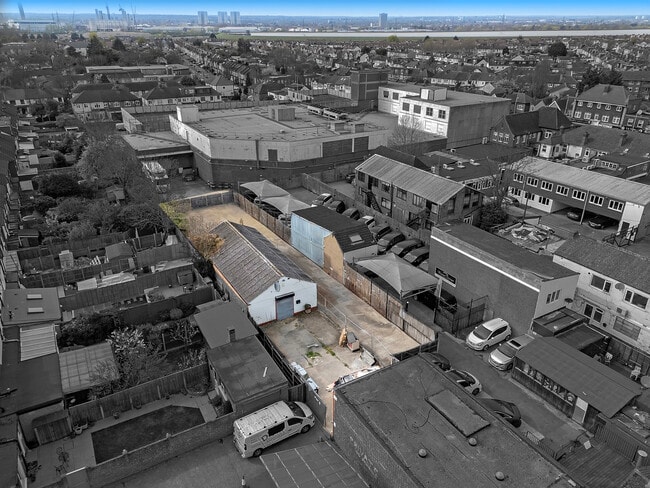

The thriving commercial centre and excellent transport links in Homerton make it an ideal location for businesses to find suitable Industrial Property for sale.

How much does it cost to buy Industrial Property in Homerton?

The average price/SF for Industrial Property for sale in Homerton is about. The cost per sq ft for Industrial Property in Homerton ranges from to , depending on the location and the size of the property.

What factors could affect the prices of Industrial Properties in Homerton?

Several factors can impact the price of Industrial Properties, including the size and location of the property, its net initial yield, and the amenities it offers. Prices currently range from to per square foot. While the average net initial yield for Industrial Properties is.

What is the largest Industrial Property available for sale in Homerton?

Currently, the largest Industrial Property available to buy is and the smallest is. The average size of Industrial Property available for sale in Homerton is approximately.

Why invest in industrial property in the UK?

Industrial property is a strong-performing asset class, offering stable rental yields, growing tenant demand, and relatively low vacancy rates. The rise of e-commerce and logistics has further increased demand for warehouses and distribution space.

What types of industrial properties are available to buy in Homerton?

You’ll find a range of industrial assets including light industrial units, storage depots, warehouses, manufacturing sites, and logistics centres. Properties may be single-let, multi-let, or part of larger estates.

What should I consider before buying industrial property?

Key considerations include location, access to transport routes, tenant demand, condition of the building, lease status (vacant or tenanted), yield potential, and long-term capital growth. It's also essential to review planning use class and site constraints.

What is a good rental yield for industrial property?

Rental yields vary by region and risk profile. In 2025, typical net yields range from 5% to 7% in regional areas, and 3.5% to 5% in prime locations such as London or the South East. Yields depend on tenancy, lease length, and asset quality.

Do I need to pay VAT or Stamp Duty on industrial property purchases?

Yes. Commercial property purchases are usually subject to Stamp Duty Land Tax (SDLT). VAT may also apply if the seller has opted to tax the property. Always get tax advice before proceeding with a purchase.

Can I buy industrial property through a pension or company?

Yes. Many investors purchase through a limited company or a pension scheme such as a SIPP or SSAS. These structures can offer tax advantages but involve specific rules and administrative responsibilities.

Is it better to buy a vacant unit or one with a tenant in place?

It depends on your strategy. Tenanted properties provide immediate rental income and stability, while vacant units may offer opportunities to refurbish, reposition, or secure higher-value tenants — though they come with short-term risk.

What are the risks of buying industrial property?

Risks include tenant default, lease voids, unexpected maintenance costs, planning restrictions, and market fluctuations. Mitigating these requires good due diligence, professional advice, and strategic asset management.

How do I finance an industrial property purchase?

Commercial mortgages are available from banks and specialist lenders. Loan-to-value (LTV) ratios typically range from 60% to 75%, and terms depend on income from the asset, buyer profile, and lender requirements.

Where can I find industrial properties for sale in Homerton?

You can search on LoopNet and shortlist interesting opportunities. Working with local agents who specialise in industrial sales can also help uncover off-market opportunities.

View on Map

View on Map