The Fountain Centre - 10-15 The Blvd

London, SW6 2UB

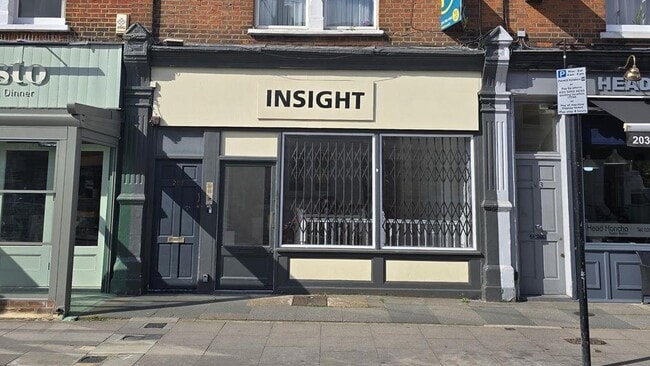

- Office for Sale

- £737,200

- 485 - 2,327 sq ft

- 3 Units Available

Including shops for sale, high street units, retail warehouses, petrol stations, showrooms, and leisure-focused retail spaces.

View on Map

View on Map

With 5 retail units currently available for sale in SW6, the area presents a solid opportunity for investors seeking income-producing commercial property. Shops and retail premises remain a resilient asset class in SW6, particularly in high-footfall streets, suburban centres, and growing residential areas. Investors can choose from single-let high street shops, parade investments, convenience stores, and mixed-use buildings with both retail and residential components. Tenants often include local independents, cafés, national chains, and essential services such as pharmacies or food outlets, providing reliable rental income and long-term potential.

When purchasing a retail property in SW6, key considerations include location footfall, tenant strength, lease terms, and scope for asset management. Prime areas close to transport links, schools, or densely populated neighbourhoods are typically in higher demand. Investors should assess the EPC rating, permitted use under Class E, and whether there’s potential to convert upper floors or reconfigure the unit. Well-let shops with full repairing and insuring (FRI) leases and upward-only rent reviews offer strong yield stability, while underused stock may present redevelopment or repositioning opportunities. With the right due diligence, retail units in SW6 can form a valuable part of a diversified investment portfolio.

LoopNet - the worlds No. 1 commercial property marketplace.